PhonePe, Google Pay, and Paytm lead India’s UPI market. PhonePe handles over 9,400 million transactions (48%), Google Pay 7,166 million (35%), and Paytm 1,523 million (6.1%), highlighting their dominant role in India’s digital payments.

Together, they showcase rapid adoption, growing competition, and the evolving dynamics of India’s UPI ecosystem.

In this article, we will explore these top apps individually and examine emerging players like Navi, super.money, and CRED, which are innovating in niche segments.

UPI Market Overview: Top Picks

- PhonePe leads the UPI market value with 48%, followed by Google Pay with 35% and Paytm with 6.1%.

- Apps like Navi, super.money, CRED, BHIM, and Amazon Pay are emerging by focusing on various niches.

- NPCI’s 30% volume cap per app aims to prevent market over-concentration and foster competition.

- UPI transactions increased from 1,207 million in FY18 to 97,295 million in FY24, indicating fast adoption.

- In October 2025, UPI transaction value increased by 9.55% MoM to ₹27.27 lakh crore, driven by surges during festivals and by merchants.

- UPI is expected to maintain more than 80% of digital payment volume, while international expansion may affect market shares.

Top UPI Apps by Market Share

PhonePe leads the UPI market, followed by Google Pay and Paytm. Let’s take a closer look at the top apps by transaction volume and value, as well as emerging players.

The following data shows the market share of the leading UPI apps as of October 2025.

By Transaction Volume & Value

Let us look at the top UPI apps contributing to the UPI market share by transaction volume and value

1. PhonePe

PhonePe currently accounts for 45.5% of overall UPI volume, with over 9,400 million transactions completed. In terms of transaction value, it commands approximately 48% of the market, with a staggering ₹13 lakh crore.

PhonePe stands out for its widespread merchant adoption, making it a popular alternative for anything from supermarket payments to bill settlements.

2. Google Pay

Google Pay follows closely with 7,166 million transactions, accounting for 34.6% of overall UPI usage. It handles ₹9.5 lakh crore in transactions, accounting for 35% of the overall UPI value.

GPay has used its simplicity and connectivity with Gmail and Android devices to provide a seamless experience for millions of consumers.

3. Paytm

While Paytm’s transaction volume (1,523 million) accounts for only 7.4% of total UPI volume, its influence in the ecosystem remains significant. The transaction value is ₹1.67 lakh crore, accounting for around 6.1% of the whole market.

Paytm continues to prioritize its loyal user base and new services such as Paytm Wallet and QR payments in tier 2 and tier 3 locations.

Emerging & Niche UPI Apps

While PhonePe, Google Pay, and Paytm dominate UPI, smaller emerging apps are innovating in unique ways, slowly creating their own space in digital payments.

The emerging UPI apps are as follows:

1. Navi UPI

Navi UPI recorded 574 million transactions, accounting for 2.8% of total UPI traffic. Its expansion is dependent on adding financing alternatives directly into the app.

Navi encourages consumers to stay engaged by providing credit solutions alongside payment options, transforming regular transactions into opportunities to manage their finances.

2. super.money

super.money utilizes the Flipkart ecosystem, with 265 million transactions and a 1.3% volume share.

Users receive cashback and points for purchases and bill payments, resulting in a loop in which the app’s utility grows alongside its shopping platform.

3. CRED

CRED concentrates on high-value, credit-savvy users, executing 158 million transactions, or approximately 0.8% of UPI activity.

Its advantage comes from rewarding premium customers with exclusive incentives, transforming basic credit card and bill payments into a loyalty-driven experience.

4. BHIM

With 136 million transactions and a 0.7% market share, BHIM remains a vital link between urban and rural India.

Government backing provides trust, while the simplicity appeals to first-time UPI consumers. BHIM shows how policy and inclusion initiatives may coexist with market competitiveness.

5. Amazon Pay

Amazon Pay recorded 94 million transactions, which account for around 0.5% of total UPI traffic.

Amazon Pay ensures that users not only pay, but also spend efficiently within a familiar platform by providing a seamless interface between payments and online purchases.

Source: Entrackr

Regulatory Impact On UPI App Market Share

UPI is formed not only by user preferences or app features, but also by regulations.

Take a look at the Regulatory Impact on UPI App Market Share:

NPCI’s Market Share Cap

At present, PhonePe (45.5%) and Google Pay (34.6%) together control over 83% of UPI volume, far above the prescribed threshold.

To tackle this, NPCI introduced a 30% volume cap per UPI app to prevent over-concentration.

Source: Livemint, Fortune India

Zero MDR Policy

UPI transactions increased from 1,207 million in FY18 to more than 97,000 million in FY24, mostly due to a zero MDR regime.

Regulation increased adoption among small enterprises and kirana outlets by reducing merchant expenses.

Source: NPCI

Bank Participation

The number of UPI-enabled banks expanded from 44 in FY17 to over 570 by FY24, and then to 685 in FY25 (as of December 2025).

This regulatory drive increased access across the country, bringing in additional users and transactions without favoring any one app.

Source: NPCI

Growth Trends Of UPI Apps Tied To Market Share

Let us look at the different trends in market share over time:

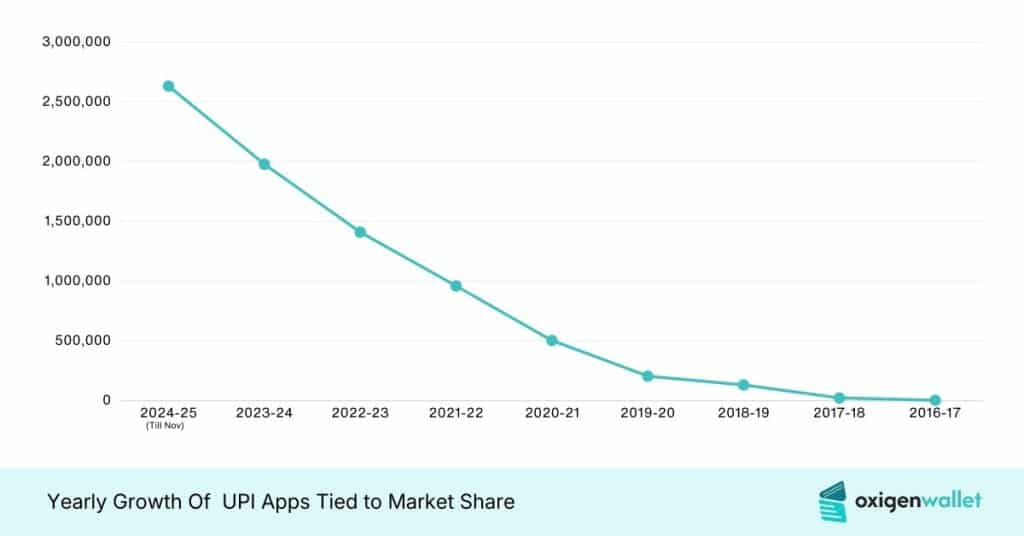

YoY Trends

The table below summarizes YoY trends:

| FY | Banks Live | Total Volume (Mn) | YoY % Volume | Total Value (₹ Cr) | YoY % Value |

|---|---|---|---|---|---|

| 2024-25 (Till Nov) | 684 | 1,85,866 | +29.4% | 26,31,632.61* | +33% |

| 2023-24 | 572 | 97,294.92 | +63% | 19,78,353.23 | +40.3% |

| 2022-23 | 399 | 69,613.66 | +98.7% | 14,10,443.01 | +46.8% |

| 2021-22 | 314 | 35,042.99 | +57.7% | 9,60,581.66 | +90% |

| 2020-21 | 216 | 22,213.34 | +91% | 5,04,886.44 | +144.5% |

| 2019-20 | 148 | 11,607.34 | +70% | 2,06,462.31 | +54.7% |

| 2018-19 | 142 | 6,830.03 | +465% | 1,33,460.72 | +452% |

| 2017-18 | 91 | 1,207.46 | +10,334% | 24,172.60 | +449% |

| 2016-17 | 44 | 11.68 | – | 4,399.53 | – |

UPI evolved from a pilot project into a mainstream payment system as both banks and users rapidly adopted it.

With merchants increasingly embracing the platform and the introduction of new features, transactions expanded beyond peer-to-peer payments, driving steady, scale-driven growth across the digital payments ecosystem.

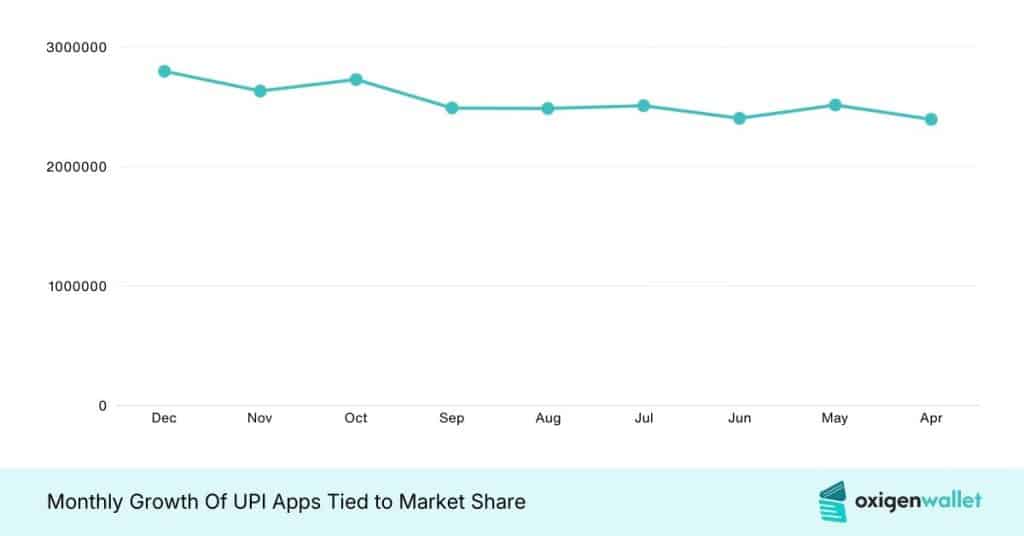

MoM Trends

In the table below, we can track monthly patterns:

| Month (2025) | Banks Live | Volume (Mn) | MoM % Volume | Value (₹ Cr) | MoM % Value |

|---|---|---|---|---|---|

| Dec | 685 | 21,634.67 | +5.70% | 27,96,712.73 | +6.28% |

| Nov | 684 | 20,466.98 | -1.14% | 26,31,632.63 | -3.53% |

| Oct | 683 | 20,700.92 | +5.44% | 27,27,790.68 | +9.55% |

| Sep | 686 | 19,633.43 | -1.87% | 24,89,736.54 | +0.017% |

| Aug | 688 | 20,008.31 | +2.74% | 24,85,472.91 | -0.92% |

| Jul | 684 | 19,467.95 | +5.85% | 25,08,498.09 | +4.36% |

| Jun | 675 | 18,395.01 | -1.51% | 24,03,930.69 | -4.39% |

| May | 673 | 18,677.46 | +4.37% | 25,14,297.01 | +4.97% |

| Apr | 668 | 17,893.42 | – | 23,94,925.87 | – |

Source: NPCI

Throughout 2025, UPI activity remained steady, supported by consistent engagement from both users and banks.

While shifting spending patterns caused monthly peaks and minor declines, reflecting timing variations, growth was actively fueled by merchants and festive transactions, sustaining scale-driven usage throughout the year.

UPI Apps Future Projections For Market Shares

India’s UPI apps market is expected to grow steadily through 2030, driven by supportive government policies and rising smartphone and internet adoption.

The UPI apps market is expected to grow at a CAGR of around 10.5% between 2024 and 2030, reflecting widespread adoption.

Increasing consumer preference for digital payments is fueling demand, with both urban and rural areas contributing to the ecosystem’s expansion.

Source: MarkNtel Advisors

Related Reads:

Conclusion: PhonePe Leads The UPI Market With 48% Market Share

PhonePe maintains its lead, with UPI transactions reaching 1,25,945 million in FY25, up 29.4% YoY, and a total value of ₹26.3 lakh crore.

Over 685 banks now support UPI, fueling adoption and merchant growth. Emerging competitors like Navi and regulations like Zero MDR actively encourage innovation, driving healthy competition.

This dynamic environment ensures the UPI ecosystem expands steadily, with more users, diverse services, and increasing value flowing through digital payments across the country.

FAQs

PhonePe leads with 9,400 million transactions, controlling 48% of the market, followed by Google Pay and Paytm.

Navi, super.money, and CRED focus on financing, rewards, and premium user engagement, gradually expanding their share in UPI transactions.

NPCI enforces a 30% volume cap per app to prevent dominance and encourage competition among UPI platforms.

Transactions rose from 1,207 million in FY18 to 97,295 million in FY24, showing rapid nationwide adoption across banks.

With 83.7% digital payment volume in FY25, UPI will maintain dominance while international expansion and regulations influence competition.