In India, there is no limit on the number of credit cards you can hold. One can have many credit cards as long as the banks approve based on income, payment history, and credit score.

Many people utilize multiple credit cards to earn points, cashback, or category-specific perks. Some have two or three, while smart users may manage several across multiple banks to maximize benefits.

In this article, we will see what factors banks consider before approving credit cards, and how to manage multiple cards effectively to maximize benefits.

RBI Guidelines On Credit Cards: What They Do and Don’t Limit

The Reserve Bank of India (RBI) does not require banks to limit the number of credit cards a person can have.

Instead, it focuses on ensuring that banks serve their clients fairly, disclose all costs explicitly, and maintain openness.

| Aspect | RBI Guidelines | Bank Policies |

|---|---|---|

| Limit on number of cards | No cap | Internal limits possible |

| Objective | Consumer protection & transparency | Risk assessment & business strategy |

| Reporting requirements | Data reporting standards (credit data frequency changing) | Card issuance criteria, limit setting |

| Product features choices | Consumers to have the option to choose a card network (Visa/Mastercard/RuPay etc.). | Applies per bank’s offerings |

This demonstrates that, while the RBI establishes the rules of the game, banks choose how many cards you can really hold, weighing your needs against their risk management.

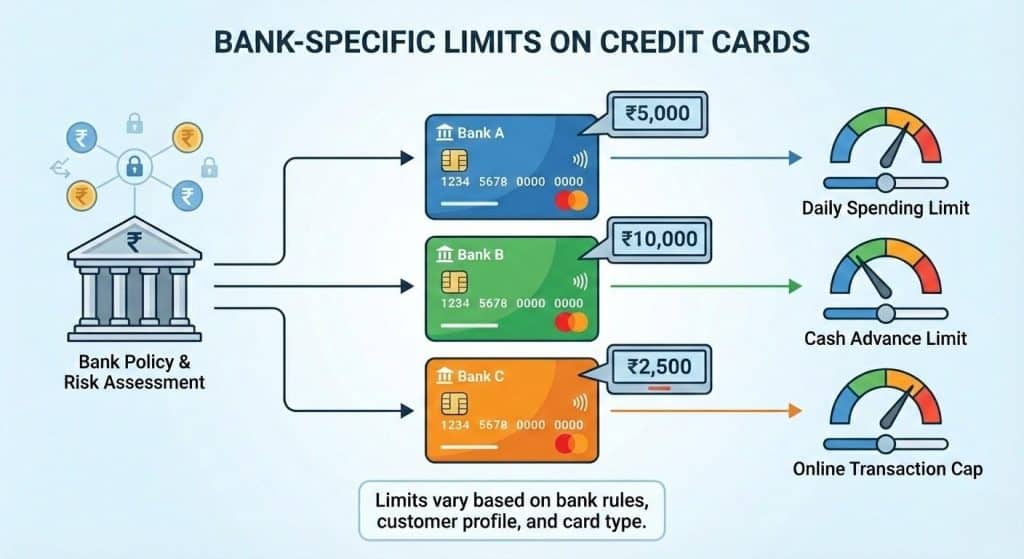

Bank-Specific Limits on Credit Cards per Person

Even though the RBI does not limit the quantity of credit cards issued, each bank has its own set of guidelines. Banks consider your income, credit score, payment history, and current credit exposure when approving several cards.

Some banks like HDFC Bank and Axis Bank may readily accept two or three cards, while others may limit you to just one, particularly if your overall credit limit is very high.

These limits are not uniform; they vary from bank to bank and, occasionally, even between card types. Premium cards may have tighter approval requirements, whereas basic or rewards cards may be easy to obtain.

Banks also consider your overall exposure across all of their products, including personal loans and home loans, when considering whether to issue new cards.

Managing numerous cards responsibly is the only way to persuade a bank that you can handle more.

Can You Hold Credit Cards From Multiple Banks?

You can hold multiple credit cards from multiple banks. Many people use cards from different banks to earn extra rewards, cashback, and other benefits.

Having a card with one bank does not prevent you from applying for another, as long as you meet each bank’s approval criteria.

But managing cards from several banks requires care. Different billing cycles, repayment schedules, and interest rates are the outcome of using multiple cards.

Your credit score, which is tracked by banks nationwide through credit bureaus, can be impacted by even one missed payment if it is handled improperly.

Holding cards from numerous banks, when used appropriately, can provide you with financial flexibility and access to benefits that a single card cannot.

Factors That Decide How Many Credit Cards You Can Have

While there is no legal restriction on the number of credit cards you can have in India, banks will carefully review your financial status before authorizing numerous cards.

The idea is to demonstrate that you can manage cards appropriately rather than simply applying for them. Here are the primary elements influencing approvals:

Income and Employment

Your monthly income is a major aspect in bank checks. A greater and more stable salary indicates that you can pay your credit card obligations on time, making it easier to obtain many cards.

For instance, banks such as Axis Bank require a minimum monthly income of about ₹15,000 for basic credit cards, although eligibility criteria can vary depending on the card type and features.

Salaried persons or professionals with continuous incomes typically receive approvals faster than those with sporadic or freelancing income.

Credit Score and Credit History

Banks use your credit score (such as CIBIL) to assess how responsibly you’ve handled debt in the past.

A score of 750 or above is generally considered good and increases your chances of getting approved for multiple cards with favourable terms.

A strong credit score increases your chances of acquiring many cards; a history of late payments or defaults may limit your options. Your credit conduct today has a direct impact on the cards you can receive tomorrow.

Existing Credit Exposure

If you currently have loans, credit cards, or high outstanding balances, banks may prohibit new card approvals.

They want to guarantee that your total credit exposure does not exceed your repayment ability. This protects you and the bank from financial stress.

Repayment History

Even if your income and credit score are strong, banks look at how consistently you’ve paid previous payments.

Timely payments on all accounts demonstrate discipline and boost your chances of receiving new cards. Missed or delayed payments can suggest a risk, prompting banks to exercise caution.

Impact Of Multiple Credit Cards On Your Credit Score

Having multiple credit cards can affect your credit score positively or negatively, depending on how you manage them.

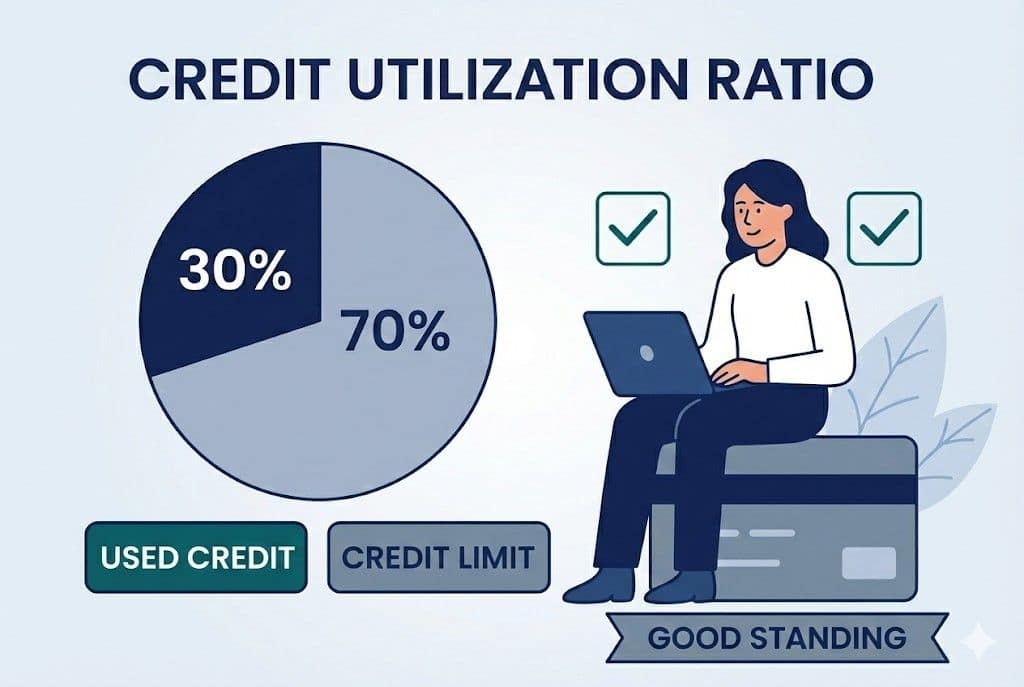

Keeping a low credit utilization ratio by spreading spending across cards can improve your score, while overspending can hurt it.

Paying all cards on time strengthens your payment history, and keeping older cards open helps maintain a good account age.

Too many new cards at once can affect your credit score, so always aim for careful, balanced use.

Benefits Of Having Multiple Credit Cards In India

Having more than one credit card might provide you with financial freedom and allow you take advantage of rewards:

The benefits are as follows:

- Better rewards/cashback: To optimize cashback and reward points, choose the appropriate card for each category.

- Flexible credit for emergencies: When unexpected expenses arise, having multiple cards on hand might give backup credit.

- Lower utilization ratio if managed: Spreading expenses across multiple cards will help you maintain a low credit utilization ratio, which enhances your credit score.

- Access to different card perks: Some cards offer dining, travel, or shopping privileges, giving more options and benefits.

- Higher total credit limit: Multiple cards can increase your overall available credit, offering more financial flexibility when needed.

Risks Of Holding Too Many Credit Cards

Having multiple credit cards might backfire if not managed properly. You can experience the risk below for holding too many cards

- Overspending: More credit can lead to spending that exceeds your budget.

- Missed payments hurt your score: Even missing a single payment on a card can hurt your credit score.

- Complexity in tracking payments: Multiple billing cycles and due dates might complicate financial administration.

- High annual fees: Holding many premium cards can result in large cumulative annual fees if not used effectively.

Suggested Reads:

Conclusion: There Is No Fixed Limit On The Number Of Credit Cards In India

A person in India can technically have many credit cards because there is no legal limit. Banks authorize cards depending on your income, credit score, and current credit exposure.

Multiple cards might help you maximize rewards, cashback, and financial flexibility, but improper use can harm your credit score.

Regular monitoring ensures balances stay manageable, preventing unnecessary debt accumulation. To make the most of having multiple cards, use them responsibly and pay on time.

FAQs

No, the RBI makes sure that banks function fairly and openly rather than imposing a numerical cap.

Yes, using credit cards properly can improve your credit score, but overspending or late payments can damage it.

Indeed, credit bureaus monitor all of your loans and credit cards, which banks check before approving new ones.

To maximize rewards and keep a good credit rating, most consumers only need two to three well-managed cards.

Yes, if your salary and credit history match bank requirements; nevertheless, make sure you can handle repayments to avoid penalties.