A UPI ID, also known as a Virtual Payment Address (VPA), is a unique digital identity that connects directly to your bank account.

It enables you to pay and receive money swiftly and securely using UPI-enabled apps, without disclosing vital banking information.

In this article, we’ll go over the structure, components, usage, benefits, and 2025 updates for UPI IDs, so you may understand how to use this system for fast, safe, and convenient digital payments.

UPI ID: Key Takeaways

- A UPI ID (or Virtual Payment Address) connects straight to your bank account without requiring sensitive information.

- Includes a username, a separator (@), and a bank or app handle, such as name@upi.

- Allows for 24/7 real-time transactions between banks and UPI apps.

- Simple setup using apps like Google Pay, PhonePe, Paytm, or BHIM; you may transfer and receive money, pay merchants, and check balances.

- Default mobile-based IDs, balance check limits, and P2P collection restrictions

- Privacy, interoperability, no fees, and simple financial administration.

Structure Of A UPI ID

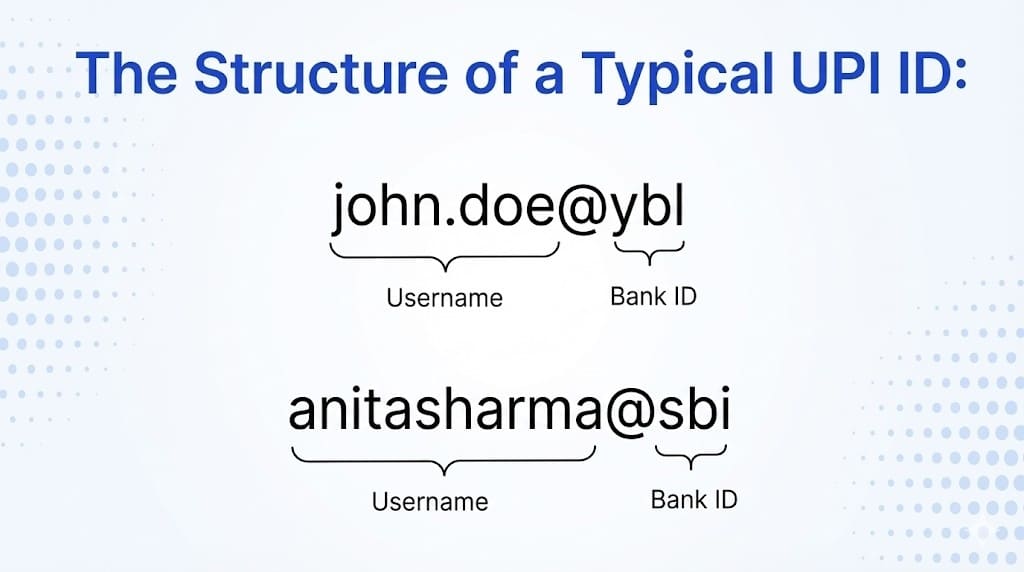

Apps and banks can easily process transactions with a UPI ID because of its clear, well-defined structure. It is a unique identifier made up of a bank or app handle, a separator, and a username.

Each UPI ID is guaranteed to be globally unique and safely connected to the relevant bank account due to this structure.

The design is basic but effective: the username identifies the user, the separator separates components, and the handle directs payment to the appropriate bank or app.

Together, they form a complete VPA that may be used for quick money transfers without disclosing critical banking information.

Components Of A UPI ID

A UPI ID consists of specific key components. Understanding them allows you to quickly create, share, and validate your ID.

Let us look at the components one by one:

Username

The username is the first part of your UPI ID. It may be chosen by the user or generated automatically by the app. For example, in rahul@okhdfc, the username is “rahul”. This distinguishes and identifies your ID while keeping your bank account number private.

Separator

The separator, generally @, connects the username and handle. Although basic, it helps the system distinguish between the personal ID and the bank/app provider.

UPI Handle

The UPI handle identifies the bank or payment app associated with the ID. Examples include okhdfc, paytm, and ybl. This guarantees that the money is routed accurately and the transaction is completed immediately. Handles are standardized and regulated by NPCI.

Complete UPI ID

The whole UPI ID includes the username, separator, and handle, such as yourname@upi. This is the complete Virtual Payment Address that you use to receive funds. It is safe, easy to remember, and used as a digital financial identification.

How A UPI ID Works In Online Payments

A UPI ID enables fast, secure online payments by acting as a digital identifier linked directly to your bank account.

Here’s how a UPI ID works to make online payments:

- Enter UPI ID or scan QR: The sender enters the recipient’s UPI ID or scans a QR code to accurately initiate the payment.

- Enter amount and UPI PIN: The transfer amount is entered along with the UPI PIN, which authorizes the transaction securely.

- Authentication by NPCI: NPCI verifies transaction details, account validity, and available balance in real time.

- Transfer completed instantly: Funds are credited within seconds, even outside banking hours, through UPI’s real-time settlement system.

How To Create A UPI ID Step-by-Step

Creating a UPI ID is quick, secure, and simple. In a matter of minutes, you may link your bank account to a UPI-enabled app and begin sending or receiving money.

Below are the steps to create a UPI ID:

Step 1: Download A UPI App

Install a reliable UPI app like Google Pay, PhonePe, BHIM, or Paytm on your smartphone.

Step 2: Register Your Mobile Number

Next, register using the mobile number associated with your bank account. This ensures that the app can securely retrieve your banking information while preventing illegal access.

Step 3: Link Your Bank Account

The app uses your registered mobile number to automatically identify your bank account.

Step 4: Set Your UPI PIN

Create a six-digit UPI PIN that will serve as a security layer for each transaction. The PIN ensures that only you can authorize payments, keeping your digital transactions secure and fraud-free.

Step 5: Choose or Create Your UPI ID

Choose a unique username or let the app generate one, then combine it with the bank/app handle to create your entire UPI ID (e.g., yourname@upi).

Step 6: Verify your UPI ID and complete setup

Finally, verify your UPI ID in the app. Once confirmed, your ID will be fully functional, allowing you to send and receive money immediately between banks and apps.

Types and Formats Of UPI IDs

UPI IDs can be presented in different ways depending on the app or bank you are using.

Here are the apps from which you can choose to create a UPI ID:

Google Pay (GPay)

Google Pay users can create a UPI ID by entering a custom username or a registered cellphone number, followed by a bank-specific handle such as @okhdfc or @okaxis.

PhonePe

PhonePe UPI IDs can be generated with a name or phone number and a YES Bank handle (@ybl). This standardized handle enables quick, secure transfers across multiple banks by leveraging PhonePe’s extensive UPI network connections.

Paytm

Paytm generally employs mobile-based UPI IDs, such as number@paytm. This style is ideal for users who want quick setup and recall, particularly for regular transactions with merchants or peers.

BHIM

BHIM UPI IDs commonly use a generic NPCI format, such as name@upi. This uniform protocol assures interoperability of transactions across all UPI apps and banks, making it India’s most standardized method.

How To Use A UPI ID

Using a UPI ID is quick, safe, and easy. Once generated, your UPI ID functions as a digital address for your bank account, allowing you to send and receive money.

Here are the primary ways you can use a UPI ID:

- Send Money: Provide your UPI PIN to the recipient, specify the amount, and authorize the transaction using their UPI PIN. Quick and safe transaction processing is ensured.

- Receive Money: When you disclose your UPI ID to loved ones, clients, or acquaintances, you can receive payments directly into your linked bank account.

- Pay Merchants: Pay with your UPI ID at stores by scanning QR codes or entering the merchant’s ID into your app.

- Link Multiple Bank Accounts: A lot of apps enable the linking of multiple accounts to a single UPI ID, simplifying flexible fund management.

- Check Account Balance or Transaction History: Some UPI apps allow checking of your balance and recent transactions using your UPI ID code for real-time information.

2026 Updates & Limitations Of UPI ID

UPI continues to evolve, and in 2026, there are a few significant updates and limits for users to be aware of.

- Transaction ID: UPI transaction IDs must be alphanumeric by 2025. With this update, banks and apps can be synchronized with each other more efficiently, particularly for large transactions, and errors are reduced.

- Balance Check: With each app, users can now check their account balance up to 50 times a day. In addition to limiting frequent searches, this also reduces server load and eliminates unnecessary system delays during periods of high transaction volume.

- Collect Request: Regular users are no longer willing to accept P2P collection requests. The presence of certified businesses and merchants is critical for preventing fraudulent transactions and ensuring their legality.

- Default UPI ID Format: Many apps now use mobile-number-based UPI IDs, which restricts the creation of custom IDs.

While this simplifies setup and assures compatibility, customers who prefer individual usernames may have to adapt to this standard format.

Benefits Of A UPI ID

UPI has formed the backbone of India’s real-time payments ecosystem, enabling billions of transactions every month.

Below are some benefits that UPI provides:

- No bank details needed: You can make payments without sharing sensitive bank information, helping keep your personal data private and secure.

- Instant transfers: Money is sent and received in real time, 24×7, including weekends and holidays.

- Universal across banks: Works seamlessly across all participating banks, so you can pay anyone regardless of their bank.

- Zero charges: Most transactions are completely free, making it a cost-effective payment option.

- High security: Uses multi-layer authentication and advanced security measures to protect every transaction.

Related Reads:

Conclusion: UPI ID Is A Virtual Payment Address

A UPI ID is a secure virtual payment address that links directly to your bank account and enables instant digital payments.

Overall, UPI IDs simplify money transfers by eliminating the need to share bank details while offering 24/7 real-time transactions across apps and banks.

With strong security, zero charges, and growing standardization in 2025, UPI IDs remain a fast, reliable, and essential tool that powers India’s digital payments ecosystem.

FAQs

Yes, the same bank account can link to multiple apps, but some apps generate separate UPI IDs per platform only.

If the UPI ID is not available, the transaction will fail. Unlike IFSC-based transfers, UPI is completely dependent on the validity of the ID.

In 2025, banks set daily UPI limits, usually ₹1–2 lakh for users, while merchants receive higher limits based on agreements.

To reduce fraud and illegal payment requests, the NPCI restricts collection requests to merchants and certified businesses. Individuals can still receive money by providing their UPI ID or QR code.

To ensure consistency, many apps now use mobile-number-based UPI IDs by default. Custom usernames may still be allowed on some apps.