Paying rent with a credit card is possible in India in 2026, but it’s not as straightforward as a regular store payment.

Most landlords do not accept card payments directly, so tenants rely on third-party apps that charge a small fee and come with certain rules.

People typically use this option when their salary arrives after the rent due date, to earn rewards, build credit history, or gain a short financial buffer until the next paycheck.

This article explains how credit card rent payments work, the costs involved, and when it makes sense to use them.

Paying Rent With Credit Cards: Key Takeaways

- You can pay rent with a credit card in India, but usually through third-party platforms rather than directly to landlords.

- Processing fees (around 0.39%–2%) and card reward exclusions determine whether the method is truly worthwhile.

- Paying rent via credit card makes sense only if you repay the full card bill on time and use a card that gives rewards.

- Credit-card rent payments can help with cash-flow delays, milestone rewards, and documentation, but become costly without discipline.

- Use this method only when rewards or convenience outweigh the cost; otherwise, UPI or bank transfer is safer and cheaper.

Is It Possible To Pay Rent With A Credit Card? (2026)

Yes, paying rent with a credit card in India is possible, but usually not directly to the landlord.

Since most landlords do not accept cards, tenants use third-party platforms that charge the card and transfer the rent to the landlord’s bank account.

While RBI payment aggregator rules caused apps like PhonePe, Paytm, and CRED to shut down payment features, specialised rent platforms and some bank-linked systems still offer it legally.

For many tenants, this method also helps earn rewards, manage cash flow, and generate valid rent receipts for HRA and records.

Platforms That Allow Rent Payments With Credit Cards in India

Paying rent with a credit card has become a practical option for many tenants in India, especially with the rise of digital rent-payment platforms.

Below is a detailed look at the major platforms that continue to support credit-card-based rent payments in 2026.

RedGiraffe (RentPay)

RedGiraffe is widely regarded as the most trustworthy and cost-effective platform for paying rent via credit cards in India.

It allows tenants to pay their rent conveniently using a credit card, while ensuring secure transactions and minimal fees compared to other services.

Why it stands out:

- Lowest processing fee in the industry, only 0.39% + GST, making it significantly cheaper than other apps.

- Integrated with major banks such as HDFC, ICICI, Kotak, SBI, Axis, and others through their net banking or BillPay sections.

- Highly compliant and regulated, following the RBI guidelines strictly.

- Mandatory landlord verification, which requires submitting proof such as a rent agreement or owner details, results in clean, transparent transactions.

Best for: Tenants seeking the lowest processing fees and a stable, compliance-focused rent payment option that works reliably every month without sudden changes or high charges.

NoBroker

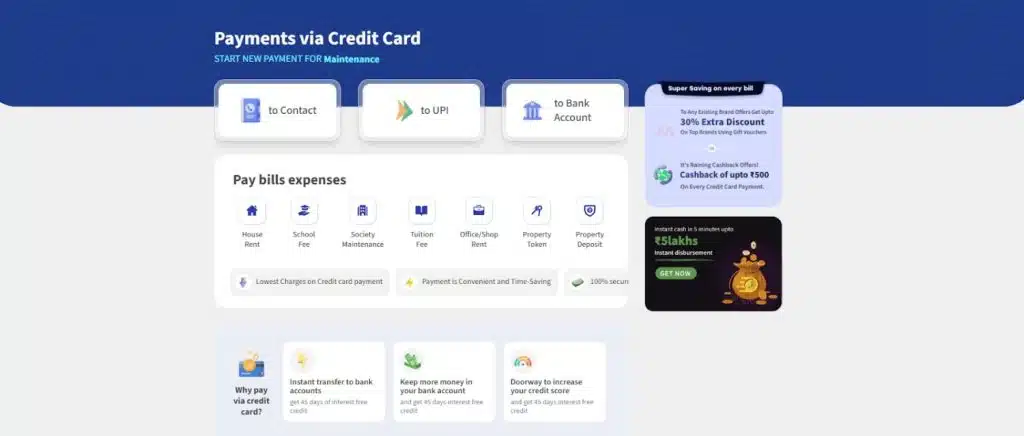

NoBroker is one of the most convenient platforms for rent payments, offering a quick setup and flexible payment options.

It allows tenants to schedule payments easily, supports multiple payment methods, and ensures secure transactions, making it a hassle-free choice for managing monthly rent.

Key features:

- Charges a 1% to 2% fee depending on the credit card network, type, and periodic offers.

- Very easy to set up, it does not require a rental agreement for basic rent payments.

- Allows payment not only for rent but also for maintenance charges, deposits, school fees, and token amounts.

- Fast processing with instant payment receipts and tracking.

Best for: Tenants who prioritise speed and easy setup over low fees and want a flexible, quick solution without landlord verification, even at a slightly higher cost.

Direct Bank Platforms (Limited Availability)

Some banks allow rent payments to be made directly through their systems using credit cards, though availability is inconsistent.

Common methods:

- Credit card bill-payment sections inside the net banking.

- Bank merchant partners (e.g., integrating with rent portals).

- Co-branded programs, such as exclusive rent-payment partnerships.

However, these options vary widely between banks and may not be available to all customers.

Best for: Customers whose banks support credit card rent payments and who prefer a secure, bank-managed system over third-party platforms.

Which Credit Cards Work Best For Rent Payments?

Choosing the right credit card for rent payments can help maximize rewards, cashback, and benefits while minimizing fees.

Here are the Credit Cards that Work Best for Rent Payments:

| Card Name | Typical Benefit | Good For |

|---|---|---|

| SBI Cashback Card | Up to 5% cashback on online spends | Users who want a simple reward structure |

| HDFC Regalia | Reward points convertible to flights/hotels | Frequent travelers |

| HDFC Infinia | Premium rewards, higher RP value | High-spend customers |

| Axis ACE | 1.5%–5% cashback depending on category | Casual spenders |

| Axis Magnus | Milestone-based rewards | High spend users |

| ICICI Amazon Pay Card | 1–5% cashback | Amazon ecosystem users |

| Kotak White Pass Cards | Milestone points | Users hitting spend thresholds |

Note: Many credit cards have reduced or eliminated rewards, cashback, and milestone benefits on rent payments, and some exclude this category altogether.

Since policies keep changing due to misuse and regulatory updates, always review your card’s latest terms and the platform’s processing fees before making high-value rent payments.

How To Pay Rent With A Credit Card

Paying rent with a credit card has become a convenient option for many tenants in India, especially with the rise of reliable rent-payment platforms.

Here’s a general step-by-step guide to help you complete your rent payment smoothly and safely.

Step 1: Confirm payment options

Ask your landlord or property manager whether credit cards are accepted directly or if you must use a third-party rent payment platform.

Step 2: Select a payment method

Choose between a landlord portal, a rent payment service, or an approved wallet app that allows rent payments using a credit card, such as, NoBroker or RedGiraffe

Step 3: Review charges and limits

Check the processing fee, usually 1.5%–3%, and confirm your card has enough available limit to cover rent plus fees.

Step 4: Enter payment details

Log in to the platform, add rent details, select your credit card, review the final amount, and confirm the transaction.

Step 5: Save payment proof

Download or screenshot the receipt and keep the confirmation until your landlord acknowledges receiving the rent amount.

Step 6: Monitor transfer time

Third-party services may take one to three working days to transfer funds, so track the payment until it reaches your landlord.

Step 7: Clear your card dues

Pay the full credit card bill before the due date to avoid interest charges and ensure rewards or benefits remain valid.

Costs of Paying Rent Through A Credit Card

Paying rent with a credit card may seem convenient, but it comes with several hidden costs that many tenants overlook.

Understanding these costs helps you decide whether the benefits outweigh the expenses.

| Cost / Charge Type | Typical Amount / Range | What This Cost Means |

|---|---|---|

| Processing / Convenience Fee (Percentage-based) | 1%–3% of the rent amount | Charged by rent payment platforms for using a credit card instead of a bank transfer or cash. |

| Processing Fee (Flat) | ₹99–₹199 + GST (India) | A fixed fee charged by some card issuers or platforms, regardless of the rent amount. |

| GST on Fees (India) | 18% on service charges | Tax applied only to the processing or convenience fee, not to the rent itself. |

| Interest Charges | 30%–42% annually (if unpaid) | Applies when the credit card bill is not cleared in full by the due date. |

| Credit Utilisation Impact | No fixed monetary value | High rent amounts increase the card usage ratio, which may affect the credit score temporarily. |

| Reward Limitations | Varies by card issuer | Some cards reduce or block reward points or cashback on rent payments. |

Pros and Cons of Paying Rent Via Credit Card

Paying rent with a credit card can be incredibly convenient. While it offers flexibility and potential rewards, it also comes with fees and risks that tenants must consider.

Here’s a quick breakdown of the significant pros and cons.

Pros:

- Paying rent with a credit card gives extra time to manage cash flow through the billing cycle.

- Regular rent payments help build a positive credit history when the card bill is paid on time.

- Some credit cards offer reward points, cashback, or milestone benefits on rent transactions.

- Digital rent payments make tracking expenses and keeping payment records easier.

Cons:

- Most rent payment platforms charge processing fees, which increase the overall rent cost.

- Interest charges are very high if the credit card bill is not cleared in full by the due date.

- Large rent payments raise credit utilisation, which can affect a credit score temporarily.

- Many credit cards limit or exclude rewards on rent payments, reducing expected benefits.

Smart Tips to Avoid Credit Card Rent Payment Charges

Here are some clever, practical tips to help you minimise unnecessary fees and make your credit-card rent payments as cost-effective as possible.

- Choose the Lowest-Fee Platform

- Use a Card That Rewards Rent Payments

- Always Pay Your Credit Card Bill in Full

- Pay Rent Only Once a Month

- Track Monthly and Annual Milestones

- Avoid Making Payments Near the Card Due Date

- Verify the Fee Before Every Transaction

Alternatives to Credit Card Rent Payments in India

If fees are too high or the platform doesn’t support your card, these are some of the common ways to pay your rent:

1. UPI (Google Pay, PhonePe, BHIM, Paytm)

UPI remains the most convenient and widely accepted method for rent payments in India. It’s completely free, works instantly, and is preferred by most landlords because the money is credited directly to their bank account within seconds.

It’s ideal for tenants who want speed and simplicity without paying any fee.

2. Bank Transfers (NEFT/IMPS/RTGS)

Traditional bank transfers are still one of the most reliable and secure ways to pay rent. Most banks no longer charge fees for NEFT or IMPS transfers, making these methods cost-effective.

These payment modes create a clear record in your bank statement, which can be helpful during rental disputes or for HRA proof.

3. NACH Auto-Debit

If your rent amount is fixed every month, NACH auto-debit is a good option. It allows your bank to automatically deduct rent on a specific date and credit it to your landlord. It’s best for long-term tenants who want a “set it and forget it” system.

4. Post-Dated Cheques

Though less common today, many landlords, especially in semi-urban areas, still accept post-dated cheques.

Tenants typically hand over 12 cheques in advance covering the year’s rent. It also creates a reliable paper trail for both parties.

Related Reads:

Conclusion: You Can Pay Rent With A Credit Card Using Approved Platforms

Paying rent with a credit card can make sense in India, but discipline decides the outcome. The right platform and a rewards-friendly card allow better cash-flow control while adding small benefits.

The risks rise when costs get ignored. Processing fees add up fast, reward exclusions reduce value, and interest charges erase gains the moment payments fall behind.

This option works only when timing or rewards clearly exceed the extra costs, and the full bill gets cleared on time. Used carefully, it stays helpful; used casually, it becomes costly.

FAQ’s

Yes, it’s legal as long as you use a proper rent-payment platform and enter valid landlord details.

No, many cards treat rent as a special category and either reduce or block rewards.

In most cases, it’s instant or within a few hours, though sometimes it can take up to 1–2 days.

Yes, what matters is having genuine rent receipts and the landlord’s PAN, not how you paid.

You’ll be hit with high interest and late fees, which can easily cancel out any benefits.