Want to send money fast without disclosing your entire bank information? This is exactly what IMPS (Immediate Payment Service) allows you to do. IMPS is a real-time interbank fund transfer system in India that operates 24/7, including weekends and bank holidays. Money can be sent using mobile apps, online banking, ATMs, or SMS, making it a quick and easy choice for daily payments.

In this article, we will define the “IMPS Wallet Number,” explain how IMPS works, explain MMID, and why it is a safer, more convenient way to transmit or receive money. You will also learn about transaction references, step-by-step flows, benefits, and comparisons to NEFT and RTGS.

What Is IMPS?

IMPS (Immediate Payment Service) is a quick and easy way to send money in India; you can transfer payments quickly, at any time of day or night, including weekends and holidays. IMPS transfers can be completed utilizing mobile banking apps, internet banking, ATMs, or SMS, removing the need to visit a bank branch.

Money is transferred from one bank account to another in real time via IMPS, and the recipient receives it within seconds. It is helpful for regular purposes like paying bills, sending money to family, or addressing crises, as it works 24/7 across India.

What People Mean by “IMPS Wallet Number”

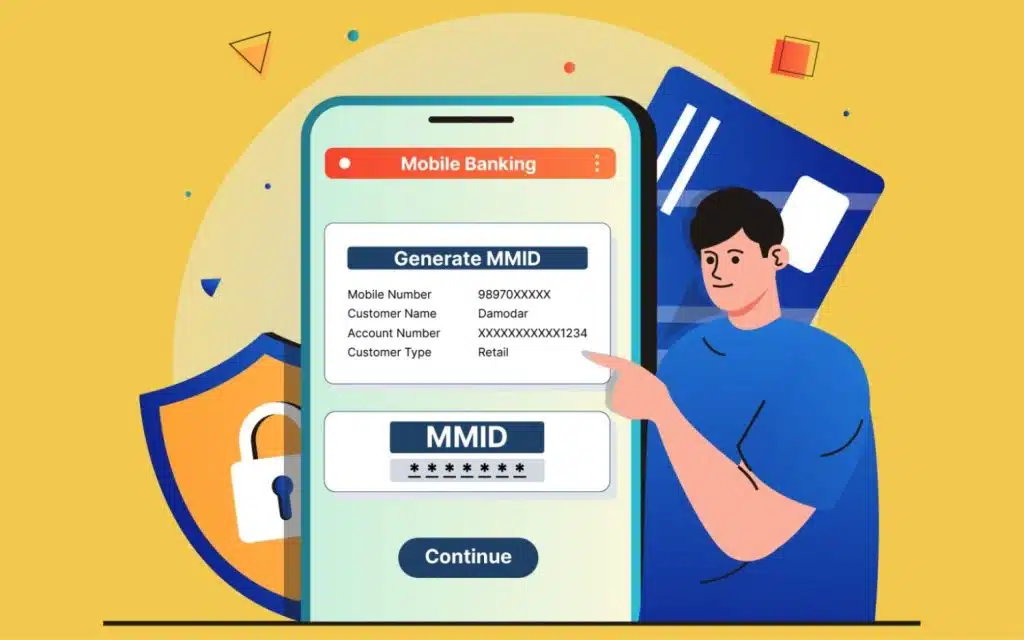

When individuals mention “IMPS Wallet Number,” they usually mean the MMID, a 7-digit identifier issued by your bank after you register for mobile banking. This MMID, along with your registered mobile number, uniquely identifies your bank account for IMPS transfers.

So, instead of revealing your entire bank account number and IFSC, you can share your mobile number and MMID — often known as a “wallet number” — which is simpler and more secure.

MMID is a convenient way to receive or send money without sharing sensitive account information, as it is linked to a single bank account (or several accounts linked to the same mobile device). From the sender’s perspective, you only need the recipient’s cellphone number and MMID.

That’s why, in ordinary banking talks, “IMPS Wallet Number” is used as a shorthand for “mobile number + MMID” – even though there is no distinct “IMPS wallet.”

How IMPS Transactions Work

The Immediate Payment Service (IMPS) allows you to send money quickly and easily. You can quickly understand the process by following these points:

- To initiate an IMPS transfer, select one of the following financial channels: mobile banking, online banking, ATM, or SMS banking.

- Enter the beneficiary information in one of two ways:

- Mobile number plus MMID (mobile money identifier), or

- Bank Account Number + IFSC Code.

These are the two officially recognized IMPS methods.

- Enter the transfer amount and confirm the transaction with an MPIN, OTP, or transaction password, depending on your bank’s security procedures.

- Funds are transmitted instantly because IMPS is meant to operate in real time.

- IMPS is available 24/7, including Sundays and bank holidays, making it ideal for urgent payments.

- Once the transaction is completed, both the sender and the receiver will receive confirmation via SMS or app notification.

- After a successful transfer, the system provides a Transaction Reference Number, which serves as both evidence of payment and a key for tracking or dispute resolution.

IMPS Transaction Reference Number

When you make an IMPS transfer, your bank generates a unique identifier called the IMPS Transaction Reference Number upon completion. Consider it the “receipt number” for that money transfer; a fingerprint confirming that a transaction occurred. This makes it incredibly useful for verifying that money was delivered and received, as well as recording a disagreement or delay.

You can simply track or validate payments using your bank account, app history, or SMS confirmation because each transfer is assigned a unique reference number. Using this reference number, you may even check transaction history across several banks to confirm facts like beneficiary, date, and amount.

Transaction Reference Details

Here’s a quick summary of what the IMPS Transaction Reference Number represents and where to find it:

| Detail | Description |

|---|---|

| Transaction ID | Unique identifier for each IMPS transfer |

| Purpose | Track transaction or lodge a dispute |

| Format | Usually 12-digit alphanumeric |

| Where to Find | SMS alert, app notification, bank statement |

Stepwise IMPS Transaction Flow

Below is a quick table showing the steps involved in completing an IMPS fund transfer:

| Step | Action | Details/Inputs Required |

|---|---|---|

| 1 | Open mobile banking/internet banking | Login credentials |

| 2 | Select IMPS transfer | Choose MMID or account number |

| 3 | Enter beneficiary details | Mobile + MMID or Account + IFSC |

| 4 | Enter amount & confirm | Review transaction |

| 5 | Receive IMPS reference number | TXN1234567890 |

Step 1 – Open mobile banking/internet banking

Begin by using your bank’s mobile banking app or online banking website. Log in with your User ID, password, MPIN, or biometric authentication. This step ensures that the transfer occurs through a safe, verified banking connection. Once logged in, go to the payments or fund transfers section.

Step 2 – Select IMPS Transfer

In the fund transfer menu, select IMPS (Immediate Payment Service). The system may ask if you wish to transfer using MMID or Account Number + IFSC. Choose which approach you like. IMPS is sometimes referred to as a real-time or instant payment method.

Step 3 – Enter beneficiary details

Now enter the receiver’s information. If you’re utilizing the mobile method, you’ll need their cellphone number and MMID (Mobile Money Identifier). If you prefer the traditional way, give their bank account number and IFSC code. These details allow IMPS to identify the exact destination account rapidly.

Step 4 – Enter amount & confirm

Next, enter the amount you wish to transfer and confirm all of the information on the page. Make sure that the beneficiary’s name, account information, and amount are right. Confirm the transfer by entering your OTP, MPIN, or transaction password, as per your bank’s security requirements.

Step 5 – Receive IMPS reference number

After the transfer is completed, you will be given a Transaction Reference Number (e.g., TXN1234567890). This serves as proof of payment and is essential for tracking, validating, and resolving any transaction disputes.

Benefits of Using IMPS

IMPS provides a quick, simple, and dependable way to send money. Here’s why so many people prefer it.

- Fast Transfers: Money is given to the recipient practically immediately, eliminating the need to wait hours or days.

- Works Anytime: Send and receive funds at any time of day or night, including weekends and bank holidays.

- Easy to Use: No need to remember lengthy bank details; simply enter your mobile number + MMID or account number + IFSC.

- Hassle-Free: Transfer money by mobile app, internet banking, ATM, or SMS/USSD (depending on your bank).

- Safe Payments: IMPS secures your transactions with OTP, MPIN, and encryption.

- Always Ready: Works for small and large payments (up to bank-defined restrictions).

Safety and Security Measures

IMPS not only works quickly, but also protects your money and data. Here’s how it provides security:

- Secure Access: To prevent unauthorized access, all transactions require login information, such as a username, password, or MPIN.

- Encrypted Transactions: Data communicated via IMPS transfers is encrypted, protecting critical information like account details and MPINs from hackers.

- Two-Factor Authentication: Most IMPS transfers require a one-time password (OTP) or MPIN for verification, adding another layer of protection.

- Fraud Detection: Banks track IMPS transactions in real time to detect suspicious activity and prevent fraud before it happens.

- Trackable Transfers: Every transaction generates a unique reference number, making it easier to verify, track, or submit a complaint when necessary.

How To Find Your MMID For IMPS Transfers

Your MMID (Mobile Money Identifier) is a unique code that connects your mobile number to your bank account for IMPS transfers. Knowing it allows you to send and receive money fast and securely without providing your entire account information.

- Via Mobile Banking App: Log in and navigate to the “IMPS / Mobile Money” section, where your MMID is usually shown with your account information.

- Through Internet Banking: After logging in, go to “Fund Transfer / IMPS”; your registered MMID may display there.

- SMS Banking: Some banks allow you to request your MMID via SMS using your registered mobile phone (check your bank’s code).

- Bank Branch: Visit your branch and request your MMID, which will be linked to your mobile number and account.

IMPS vs NEFT and RTGS

While there are several ways to transfer money between Indian banks, IMPS is particularly notable for its speed and ease of use. While NEFT and RTGS are tried-and-true methods, IMPS is available 24/7 and offers quick transfers, even on weekends and holidays. The main variations are summed up in this table:

| Feature | IMPS | NEFT | RTGS |

|---|---|---|---|

| Transfer Speed | Instant (24/7) | Same day (working hours) | Real-time (above ₹2 lakh) |

| Availability | 24/7, including holidays | Bank working hours | Bank working hours |

| Minimum/Maximum Limit | ₹1 – ₹2 lakh per txn | No minimum, upper limit varies | ₹2 lakh minimum |

| Method of Transfer | Mobile / Internet / ATM | Internet / Branch | Internet / Branch |

IMPS vs NEFT

IMPS is faster than NEFT since it transfers funds instantly, whereas NEFT is done in hourly batches during bank business hours. IMPS is the best option for making urgent payments, such as bills or emergency finances.

Another advantage of IMPS over NEFT is that it operates around the clock, including weekends and holidays. NEFT, on the other hand, is only available during bank business hours, so expect to wait if you start a transfer late in the day.

IMPS vs RTGS

IMPS is ideal for small-to-medium transfers (₹1 – ₹2 lakh per transaction) and can be used at any time. RTGS is intended for high-value transactions over ₹2 lakh, while IMPS is more accessible for day-to-day use.

Another significant distinction is ease of access. While RTGS frequently necessitates internet banking or branch visits, IMPS can be accomplished using mobile apps, online banking, or ATMs. For users who need quick, on-the-go transfers, this makes IMPS more useful.

Conclusion – Understanding IMPS Wallet Number

The IMPS Wallet Number is not a distinct wallet; it is often the MMID (Mobile Money Identifier) plus your registered mobile number, which allows you to send and receive money securely over IMPS.

This technique will enable you to transfer payments instantly, trace transactions by reference number, and avoid disclosing critical account information. IMPS is fast, secure, and available around the clock, making it suitable for both regular payments and emergencies.

FAQs

No. The IMPS Wallet Number is usually your MMID + registered mobile number, which allows you to transfer funds without disclosing your complete account number. It is a safer and more straightforward identifier for immediate payments.

Some banks allow you to link numerous accounts using the same mobile number, but each account has a unique MMID. Always confirm with your bank to avoid sending money to the wrong account.

If the MMID or mobile number does not match the account, IMPS transactions are typically refused immediately. A refund or failure message will be issued to you, but please confirm the facts before transferring.

For every transfer, use the IMPS Transaction Reference Number that was produced. You may trace the payment via your app, through an SMS alert, or on your bank statement with this 12-digit unique number.

Indeed. Depending on the bank, IMPS transactions typically permit transfers between ₹1 and ₹2 lakh. It is therefore perfect for small-to-medium-sized transactions and daily payments.