The maximum UPI transaction limit for regular users is ₹1 lakh per day, while verified merchants can transact up to ₹5–10 lakh daily.

Digital payments in India are faster, safer, and more convenient than ever, thanks to UPI. UPI has formed the foundation of instant money transfers, allowing users to send money and complete transactions in seconds.

In this article, we will discuss UPI limits, factors that influence them, how to monitor and manage them, typical challenges, and simple remedies to ensure smooth digital transactions.

UPI Transaction Limit: Key Takeaways

- Standard UPI allows ₹1 lakh per day for P2P transfers.

- High-value and merchant payments can reach ₹5–10 lakh per day.

- Limits depend on bank, account type, KYC, and app.

- Common issues include transaction failures, PIN errors, and app limits.

- Manage limits by KYC, splitting payments, contacting banks, or using higher-limit apps.

- Knowing limits ensures faster and smoother digital payments.

UPI Transaction Limits Explained

The NPCI imposes transaction restrictions on UPI to ensure that digital payments remain safe, rapid, and reliable for all.

Knowing these constraints enables users to better plan their transactions and use UPI more efficiently and effectively.

Let us understand each type in detail:

1. Standard P2P / Regular Payments

These are the standard UPI payments people make every day, like sending money to friends or moving funds between accounts.

Designed for regular use, these transactions are simple, quick, and come with a daily limit of ₹1 lakh per transaction.

This category emphasizes simplicity and speed. Banks and apps prioritize smooth processing for these transfers; therefore, this limit is broadly consistent across platforms.

2. High-Value / Verified Merchant Payments

High-value UPI payments were established to help industries such as insurance premiums, stock market investments, and government services.

These are payments in which consumers frequently need to send significant amounts of money swiftly and securely. NPCI has increased the per-transaction limit to ₹5 lakh, with a daily maximum of ₹10 lakh.

However, this higher limit applies only to verified merchants certified under specific categories. This maintains security while allowing customers to make large-scale payments without utilizing net banking or cards.

3. Business / Large-ticket P2M Payments

Large-ticket P2M (Person-to-Merchant) payments are intended for commercial, trade, and high-value merchant transactions. These payments could be vendor payouts, retail inventory payments, membership fees, or business-related expenditures.

The higher limit of ₹5 lakh per transaction enables retailers to accept instant UPI payments instead of older methods. The daily limit may be up to ₹10 lakh, depending on the merchant’s verification status and bank rules.

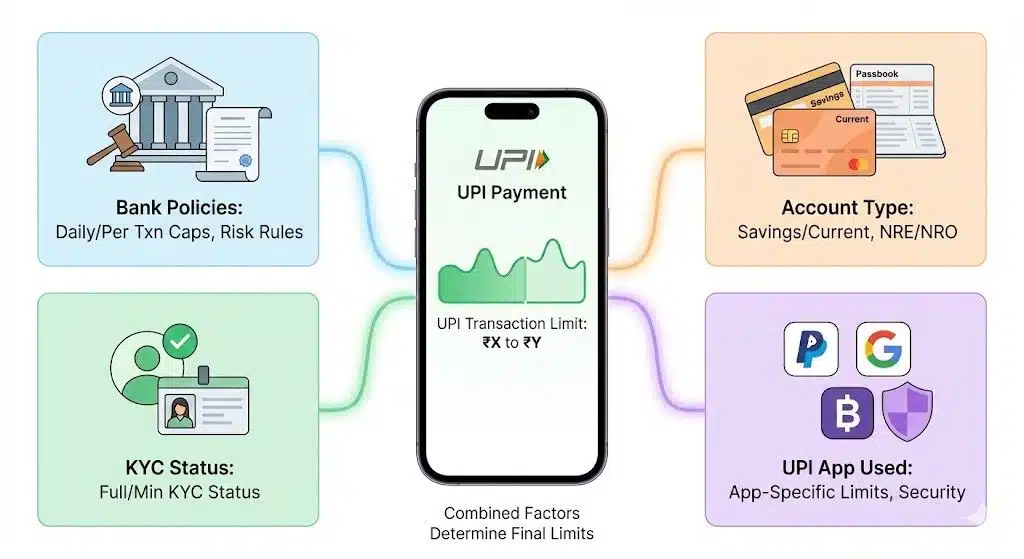

Factors Affecting UPI Transaction Limit

UPI limits depend on your bank, account type, KYC status, and even the UPI app you use; all play an essential part in determining your UPI transaction limit.

Here are the factors affecting the limit:

1. Bank Policies

Every bank creates its own UPI regulations within the NPCI’s maximum boundaries. Some banks limit transactions to ₹25,000, while others allow up to ₹1 lakh.

Banks set these restrictions depending on risk management, security, and the clients they serve.

If your acquaintance can send more money than you, it is most likely because their bank allows higher UPI limits.

Switching to a bank with more flexible policies or utilizing a different account will significantly improve your UPI experience.

2. Account Type

Savings and current accounts may have different UPI limits. Savings accounts may have lower daily limits due to security and consumer risk profiles.

Whereas current accounts, which corporations widely use, typically permit bigger transactions.

If you frequently make large transactions, a current or premium account can provide you with more flexibility. For most people, savings account limitations are sufficient for digital payments.

3. KYC Status

Your KYC status directly influences the amount you can transfer via UPI. Fully KYC-verified accounts have higher limits because banks can verify your identity and reduce transaction risk.

Non-KYC or partially KYC accounts may face harsh limits or even temporary limitations.

Completing comprehensive KYC not only increases your UPI limit but also improves security and decreases the likelihood of payment failure. It’s one of the simplest ways to increase transaction thresholds.

4. UPI App Used

Different UPI apps, like Google Pay, PhonePe, Paytm, and BHIM, might impose their own internal limits.

While the NPCI establishes the limit, each app utilizes its own caps to manage bandwidth and avoid usage.

If you reach an app-specific limit, moving to another UPI app allows you to make the payment immediately. This adaptability guarantees that app-specific limitations never constrain you.

How to Check and Manage UPI Limit

Managing the UPI transaction limit is easier than many people believe. A few steps can increase transfer limits or help avoid payment restrictions.

Below are the detailed methods to check and manage UPI Limit:

1. Complete Full KYC

Completing full KYC is the simplest approach to increase UPI limitations. Banks trust accounts that have been correctly verified, so after your KYC is updated, they enable larger payments with fewer restrictions.

Most limit-related concerns can be resolved quickly by visiting a bank branch or completing digital KYC using your UPI app.

After verification, you’ll notice smoother, faster payments and a better probability of completing large transactions.

2. Use Different Bank Accounts

If you frequently exceed your daily UPI limit, having a number of bank accounts can help you divide your payments. This is especially handy for those who make regular commercial payments or significant transactions.

Switching accounts inside the same UPI app takes seconds and can prevent payment failures in urgent scenarios.

3. Contact Bank Support

Banks may allow temporary or permanent limit hikes, particularly if you have an excellent transaction history. A brief call or visit to customer service can help you obtain a higher cap tailored to your specific needs.

This option is best suited for consumers who frequently make significant payments and prefer a more personalized service.

Banks may change your limit based on your profile, making it easier to process high-value transactions.

4. Use UPI App with Higher Limits

Not every UPI app works exactly the same—some let you send more money per transaction than others. If your app limits a payment, switching to another, like BHIM, Google Pay, or PhonePe, often solves the problem right away.

This strategy is ideal for consumers who do not want to change banks but require additional flexibility. By using an app that supports larger UPI payments, you can execute large UPI payments without pauses.

Common UPI Limit Issues and Solutions

Even though UPI is quick and convenient, customers frequently encounter problems when they reach a limit or anything goes wrong during a transfer.

The issues are as follows:

1. Transaction Failed

This usually occurs when you attempt to send more money than your per-transaction or daily UPI limit permits.

The program prevents transfers to safeguard consumers from unexpectedly large transactions. It is the system’s means of ensuring payment security and preventing misuse.

Solution: To fix this, either check your current UPI limit in the app or divide the amount into smaller transfers. If the payment is urgent, you can transfer it to another bank account or UPI app with a higher limit.

2. Payment Declined

A payment is often denied because your bank account does not have enough funds to execute the transaction.

Unlike cards, UPI relies on real-time bank transfers; thus, even a minor discrepancy can cause a refusal.

Solution: Before making a transfer, check your available balance on the app. Adding funds or selecting a different account frequently resolves the issue instantly, allowing the payment to complete smoothly.

3. UPI PIN Error

Entering an invalid UPI PIN many times results in a temporary suspension for security purposes.

This is done to protect your account against unauthorized access or questionable behavior.

Solution: If you’ve been locked out, just reset your UPI PIN via your app using your debit card information. Once reset, payments will resume normally, and you will avoid recurring failures.

4. App-Specific Limit Restriction

Some UPI apps set their own internal limits, even if the NPCI and your bank permit bigger sums. This is why a payment may fail in one app while succeeding in another.

Solution: Switching to an app with a higher internal limit, such as BHIM, PhonePe, or Google Pay, usually solves the problem quickly. When you exceed an app-based limit, try this simple workaround.

Related Reads:

Conclusion: UPI Transaction Limit Is ₹1 Lakh

Regular UPI users usually have a daily transaction limit of ₹1 lakh, while verified merchants and high-value users may get higher limits of ₹5–10 lakh. These limits vary by bank, account type, KYC status, and the UPI app you use.

As a result, completing full KYC is important. Linking multiple bank accounts or choosing UPI apps with higher limits can also help you handle larger payments without issues.

With this simple planning, UPI transactions remain smooth and uninterrupted. Understanding your limits helps avoid failed payments and makes digital transfers easier, faster, and more secure.

FAQs

UPI allows peer-to-peer transfers up to ₹1 lakh daily, covering rent, bills, and personal payments to friends or family.

Yes, verified merchants can receive up to ₹5 lakh per transaction and ₹10 lakh daily for insurance, government, or capital markets.

Yes, apps like BHIM, Google Pay, and PhonePe may impose limits lower than NPCI’s maximum per-transaction or daily allowance.

Fully KYC-verified accounts enjoy higher transaction limits; unverified accounts face lower per-transaction and daily limits, restricting high-value transfers.

If a UPI payment fails, split it, try another bank account, or use an app with higher per-transaction or daily limits.