UPI in 2025 is GST-free, except when banks or apps charge extra service or convenience fees. The money you transfer to friends, family, or merchants stays completely tax-free.

Digital payments have transformed how we handle money, making transactions faster, safer, and entirely paperless.

This article explains how GST affects UPI payments, when it applies, and which charges banks and apps can actually tax.

How GST Applies To Digital Payments

GST or Goods and Services Tax is a value-added tax levied on products and services in India. When it comes to digital payments, GST is not imposed on simple transfers of funds between accounts.

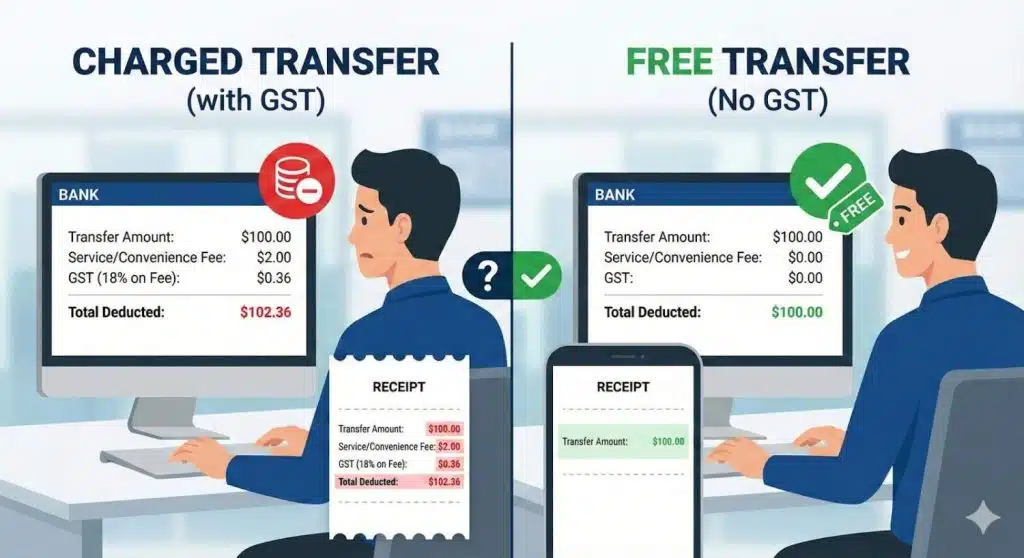

Whether you transfer or receive money through apps or online banking, the transaction is GST-free. The tax applies only if banks or payment service providers impose a service fee, convenience fee, or processing fee.

This method keeps everyday digital transactions affordable, applying GST only to payment service charges, so users clearly understand what they pay.

Types of UPI Transactions and GST Applicability

UPI fund transfers in India do not attract GST, but certain payment service charges related to these transactions may be subject to GST.

Let us look at the types in detail:

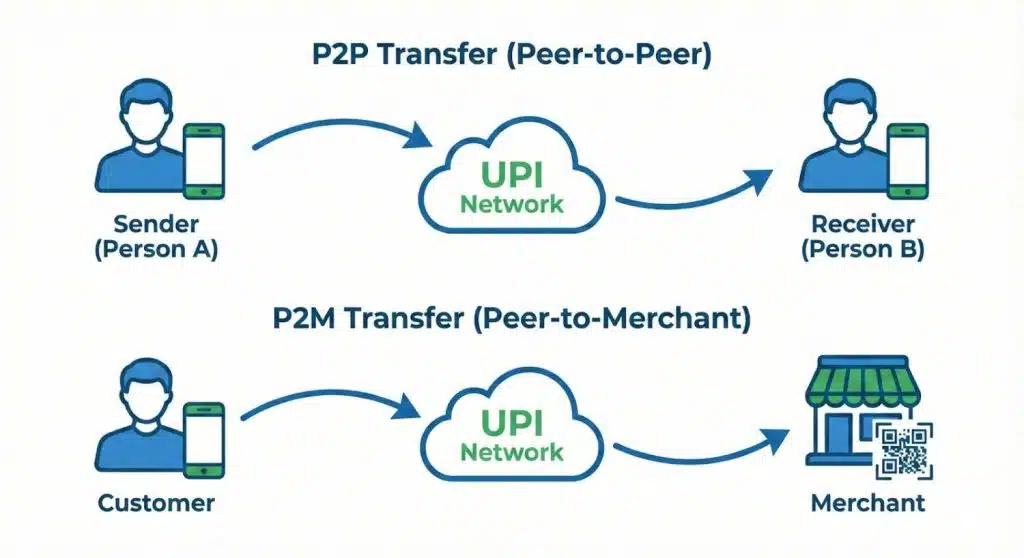

P2P (Person-to-Person) UPI

Sending money to friends, relatives, or acquaintances with UPI is easy and quick. Because this is simply a transfer of funds, it is GST-free, making it an inexpensive way to shift money.

Even if the transfer is considerable, no tax is imposed on the transaction itself. This simplifies personal transactions and eliminates unnecessary fees that would otherwise complicate simple, regular payments.

P2M (Person-to-Merchant) UPI

UPI payments at a store or online retailer are as quick as P2P transactions. The UPI transaction is GST-free, even when paying significant sums, because the government considers the payment method as a channel rather than a service.

GST is solely applicable to the goods or services you purchase, not the payment method.

Service/Fee Charges by Banks

Banks and payment applications may charge a service, convenience, or processing fee for value-added services.

These fees are classified as taxable services under GST; hence, the fee amount is subject to GST at a rate of 18%. If there is no cost, the transaction is entirely tax-free.

Why UPI Transfers Remain GST-Free

UPI transfers in India remain GST-free in 2025 because they are considered simple fund movements rather than a supply of goods or services.

Until 2024, banks and payment service providers could impose a Merchant Discount Rate (MDR) on specific transactions, and GST was applied to the fee rather than the transaction itself.

However, to promote digital payments, the government removed the MDR for UPI payments in 2025. This means that no GST is now levied on P2P or P2M transactions, making money transfers entirely tax-free.

The purpose of this move is to make digital payments more accessible and cost-effective. With MDR eliminated, only payments for additional services, such as convenience or processing costs, remain taxable.

The actual transmission of payments via UPI is not considered a taxable service; thus, individuals and businesses can continue to use UPI without incurring additional taxes.

When GST On UPI May Apply

Most UPI transactions are GST-free, but GST applies to service fees charged by banks or apps, helping users avoid surprises and stay compliant.

The different types of charges are as follows:

1. UPI Transaction Fee

Some banks or retailers may charge a transaction processing fee, sometimes known as the MDR. When this fee is in place, it is subject to GST at 18%, except for the amount transferred.

Even though the cost is usually minimal, it is considered a service offered by the bank or payment app, so GST is levied only on that component, not on the actual transfer of funds.

2. Convenience Fee

Occasionally, banks or UPI apps provide premium features or convenience services such as instant settlement or payment reminders. These fees are subject to the regular GST rate of 18%.

This ensures that additional services provided beyond the basic fund transfer are appropriately taxed while routine transactions remain free.

3. Basic UPI payment

If no cost is charged for the transaction, the transfer is fully GST-free. This applies to ordinary P2P and P2M transfers, in which money passes without any processing or service fees.

This rule makes everyday digital payments simple, fast, and economical, encouraging further adoption of cashless transactions throughout India.

Common Misconceptions About GST On UPI

Despite clear government instructions, various myths about GST on UPI transactions persist.

The table below clears up the most frequent misconceptions in 2025:

| Common Misconception | Reality (As per 2025) |

|---|---|

| UPI payments over ₹2,000 will attract GST | False – no GST on UPI, regardless of amount |

| All digital payments have GST automatically | Only when there is a fee/charge, not on free transfers |

| Merchant payments via UPI have a separate GST on the payment mode | No – GST is only on goods/services billed, not UPI transfer itself |

These explanations make it clear that everyday UPI transactions are still GST-free, whereas only service or processing fees are taxable. This basic explanation lets people avoid confusion and utilize UPI with confidence.

Related Reads:

Conclusion: GST On UPI Transactions In 2025 Is Not Charged

UPI transactions are GST-free in 2025. Only service or processing costs, such as convenience charges or MDR, are taxed. The actual transfer of funds, whether to friends, relatives, or merchants, is entirely tax-free.

This keeps digital payments in India quick, easy, and affordable, encouraging wider adoption across businesses, individuals, and everyday financial activities nationwide.

Understanding this allows consumers to make cashless payments with confidence, free of excessive taxes, and to reap the full benefits of secure, hassle-free UPI transactions.

FAQs

No. GST does not depend on transfer value; all UPI fund transfers remain GST-free, while only convenience or service fees are taxable.

No. Businesses pay GST on goods or services sold, not on UPI payments, and merchants receive full payment without transaction-method tax.

Yes. Any additional service or value-added cost offered by banks or payment apps, such as rapid settlement or reminders, is subject to 18% GST.

No. Banks cannot levy GST on free UPI transfers; transactions remain fully GST-free unless a specific service fee is charged.

Yes. With MDR removed in 2025, GST no longer applies to UPI transactions, and only optional additional service fees are taxed.