In India, you can pay your taxes with a credit card through the Income Tax Department’s e-Filing system and authorized payment gateways.

This allows taxpayers to pay income tax, advance tax, or self-assessment tax online in a timely and secure manner.

While a small convenience fee is charged, using a credit card can help manage cash flow, collect rewards, and get quick payment acknowledgment without visiting a bank.

In this article, we will guide you on how to pay your taxes in simple steps, the advantages and risks involved, along with some tips to ensure security.

Steps To Pay Tax With A Credit Card

Paying income tax with a credit card is simple and completely online. The Income Tax Department’s e-Filing platform enables you to finish the transaction securely using recognized payment gateways.

Follow the steps below:

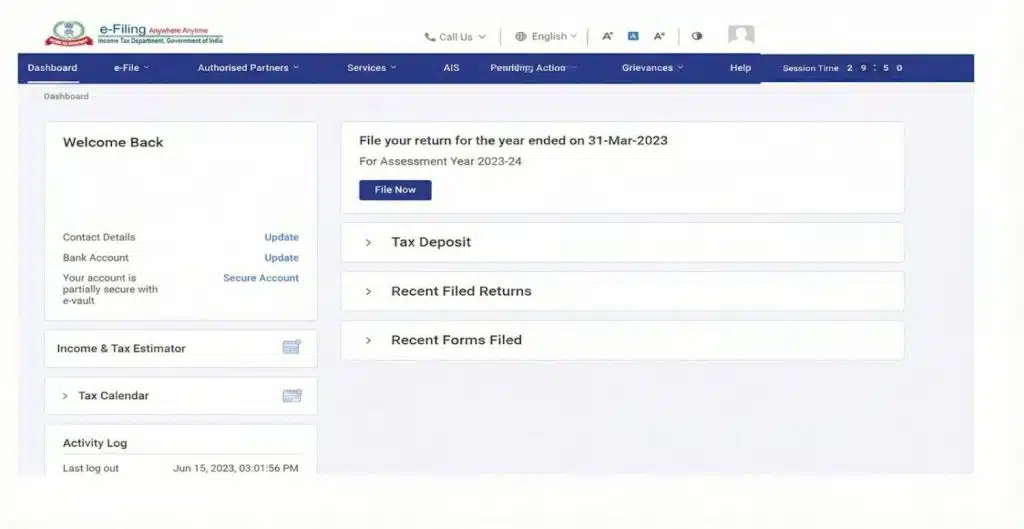

Step 1: Visit the e-Filing Portal

Open the official Income Tax e-Filing portal, where all online tax payments are initiated. This is the starting point for paying tax with a credit card.

Step 2: Navigate to e-Pay Tax

Click on e-Pay Tax to reach the section dedicated to online income tax payments. This option applies to both logged-in and guest users.

Step 3: Generate Challan / CRN

Enter your PAN and tax information to obtain a Challan Reference Number (CRN). The CRN identifies and tracks your tax payment.

Step 4: Select Payment Gateway

Choose an authorized payment gateway that accepts credit cards for income tax payments. The gateway secures the transaction.

Step 5: Enter Credit Card Details

Enter your credit card details, complete the authentication process, and confirm the payment. Once completed, you will immediately receive a receipt.

Benefits Of Paying Taxes With A Credit Card

Paying taxes with a credit card can be helpful in certain situations. The benefits are as follows:

- Quick Online Payment

The entire process is digital and can be completed without visiting a bank by using an authorized payment channel on the income tax e-Filing portal.

- Instant Payment Confirmation

When the credit card payment is successful, you will receive an immediate acknowledgement and a challan, allowing you to avoid last-minute delays or penalties.

- Useful During Urgent or Last-Minute Payments

If you are close to a tax deadline and running low on cash, a credit card can help you pay your taxes on time and avoid late fees.

- Potential Credit Card Rewards

Some credit cards may offer reward points or milestones on tax payments, depending on the card issuer’s terms and conditions.

- Secure Transaction Process

Tax payments conducted through recognized payment gateways follow standard security checks, ensuring that credit card tax payments are secure and reliable.

Risks and Downsides Of Paying Taxes With A Credit Card

While paying taxes using a credit card is convenient, it does come with some charges and risks that taxpayers should be aware of before using this payment method.

The risks are as follows:

- Extra Convenience Fees

Credit card tax payments typically incur a convenience or processing fee charged by the payment gateway, raising the overall cost of paying tax.

- Interest Charges if Not Repaid on Time

If you do not pay your credit card bill in full by the due date, interest will be applied, making tax payment much more expensive.

- Impact on Credit Utilisation

Paying a large tax amount with a credit card can increase your credit utilisation ratio, which may affect your credit score.

- Not All Cards or Banks Are Supported

Certain credit cards may be incompatible with the income tax payment gateway, resulting in rejected transactions or limited payment options.

Tips For Paying Taxes with A Credit Card

If you want to pay your taxes with a credit card, a few quick checks can help you avoid high costs and maximize the benefits of this payment method.

- Always check the convenience or processing fee charged by the payment channel before confirming your credit card tax payment.

- To avoid rejected transactions, ensure that your available credit limit is sufficient to meet the tax amount.

- Clear your credit card balances in full before the due date to prevent interest charges on your tax payment.

- Download and save the tax receipt as proof of payment for future reference or verification.

- Compare lower-cost methods such as UPI or online banking before using a credit card to pay taxes.

Related Reads:

Conclusion: You Can Pay Taxes With A Credit Card

Paying taxes using a credit card is a convenient and secure option for taxpayers. It provides ease, fast confirmation, and potential rewards, but fees and interest must be considered.

However, it is important to consider associated fees, interest rates, and transaction limits before choosing this method.

By carefully completing the e-Filing instructions, double-checking convenience charges, and paying your credit card account on time, you can make online tax payments properly.

FAQs

Yes, advance tax and self-assessment tax can be paid with a credit card via the e-Filing portal’s authorized payment channels.

Some banks offer reward points for tax payments, but many exclude them. Always check your card’s terms before paying.

Yes, payments are processed via safe, authorized channels that use encryption and standard authentication to ensure security.

If a payment fails, no taxes are deducted. You can retry with the same or a different card, but make sure your credit limit is sufficient.

No, fees differ between banks and payment gateways. It is preferable to verify the exact charges before confirming your payment.