You can buy cryptocurrency with a credit card. Major exchanges like Coinbase, Binance, and Crypto.com let you instantly purchase Bitcoin, Ethereum, and other coins by linking your card.

However, it’s not ideal for everyone. High fees, cash advance charges, and debt risks make alternatives like debit cards or bank transfers safer for some users.

In this article, we will understand how buying crypto with a credit card works, what steps are involved, and more.

How Buying Crypto With A Credit Card Works

Buying crypto with a credit card is basically like using your card for any online purchase, but instead of getting a product, you receive digital coins in your crypto account.

The card allows you to instantly transfer money to a crypto exchange, where it’s converted into cryptocurrency like Bitcoin, Ethereum, or other popular tokens. This makes it one of the fastest ways to enter the crypto market.

Step-by-Step Guide To Buying Crypto With A Credit Card

Buying cryptocurrency with a credit card can be quick and easy if you follow the steps below:

Step 1: Choosing the right exchange

Choose a reputable cryptocurrency exchange that accepts credit cards, such as Coinbase, Binance, or Crypto.com. Look for platforms with low costs, high security, and user-friendly interfaces for beginners.

Step 2: Linking your credit card

Add your credit card to your exchange account by entering your card details. Most exchanges also require identity verification (KYC) to prevent fraud and comply with regulations.

Step 3: Making the purchase

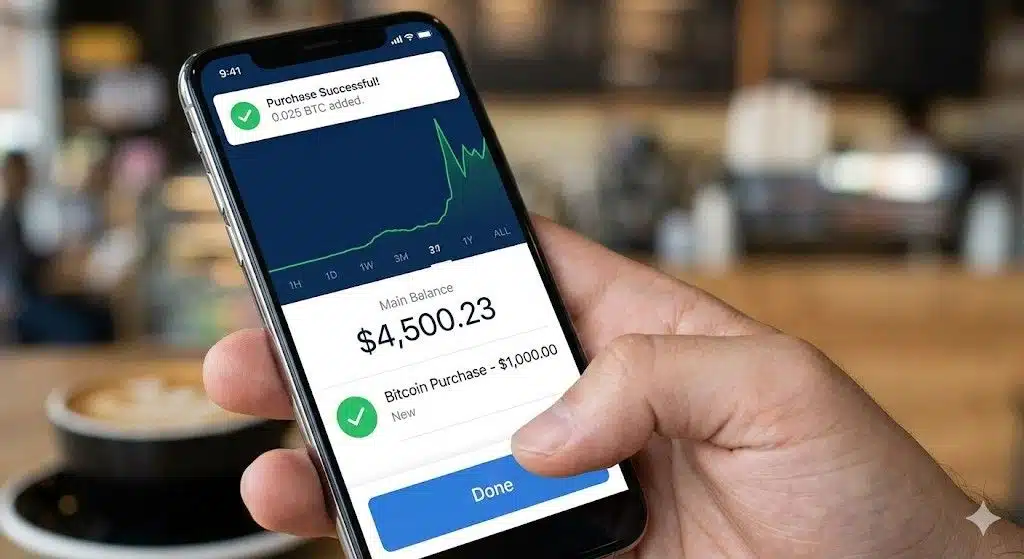

Select the cryptocurrency you want to buy, like Bitcoin or Ethereum, and enter the amount. Review the fees and complete your purchase — your cryptocurrency should appear in your account immediately.

Step 4: Storing crypto securely

After purchase, your coins are stored in the exchange’s wallet; however, for extra security, move them to a private wallet. This protects your cryptocurrency from exchange hacks or technical issues.

Alternatives To Buying Crypto With A Credit Card

If a credit card is not your preferred method of payment, there are various safe and easy alternatives to purchase cryptocurrency.

Let’s have a look at each:

1. Bank Transfers

Bank transfers are a common method for buying cryptocurrency without using a credit card.

They usually have lower fees, though transactions may take a few hours or even a few days to execute, depending on your bank.

2. Debit Cards

Debit cards function similarly to credit cards, except they frequently avoid cash advance fees and high interest rates.

It’s a simple way to purchase cryptocurrency instantaneously while keeping expenses down.

3. Digital Wallet and Payment Apps

Apps such as PayPal allow you to buy cryptocurrency directly from your bank account.

These platforms are convenient and beginner-friendly; however, costs may vary depending on the provider.

Pros and Cons Of Buying Crypto With A Credit Card

Buying cryptocurrency with a credit card can be quick and easy, but it is not necessarily the most cost-effective or secure alternative.

To assist you in making a decision, below are some pros and cons of buying crypto with a credit card you should know:

Pros

- Instant Access: Credit card purchases add cryptocurrency to your account almost immediately, allowing you to move quickly on market opportunities.

- Easy and Familiar: Most individuals already know how to use a credit card, so the process is simpler than setting up bank transfers or other payment options.

- No Bank Delay: Unlike bank transfers, which can take hours or days, credit card transactions are completed fast.

Cons

- Higher Fees: Credit card transactions often come with additional costs from both the exchange and your card provider. Some exchangers charge between 2% and 5% each purchase.

- Cash Advance Risk: Some banks treat cryptocurrency transactions as cash advances, which can start earning interest immediately.

- Debt Risk: Using borrowed funds to invest in volatile cryptocurrency can be risky; if prices fall, you may owe more than you originally invested.

Related Reads:

Conclusion: Yes, You Can Buy Crypto With A Credit Card

Using a credit card to buy cryptocurrency is quick and easy, but it carries financial risks, including higher fees and interest.

It’s best suited for people who can pay off their card debt right away and are comfortable with volatility.

By selecting a trustworthy exchange and storing cryptocurrency securely, you may still benefit from the speed and ease of credit card purchases.

FAQs

Some banks prohibit credit card payments for cryptocurrency due to cash advance regulations or risk policies. In such a case, you can try a new card, use a debit card, or initiate a bank transfer.

Yes, most exchanges have daily or monthly credit card purchase restrictions, which range from $500 to $5,000 depending on your verification level and the platform’s rules.

Usually not. Many banks classify cryptocurrency purchases as cash advances, which do not earn points or cash back and may accrue interest immediately.

Exchange wallets are convenient, but they are prone to hacking. Moving cryptocurrency to a private wallet provides complete control and increased protection.

Potentially, yes. If your bank treats it as a cash advance, or you have a large sum, it may increase your credit utilization and lower your score. Paying off the sum soon can help to reduce this danger.